What Are Pre-Issued Levies?

Strata owners and committee members must understand how their community’s finances work. Pre-issued levies are a topic that often prompts questions; but what exactly are they?

These levies are critical in maintaining your schemes financial stability during the transitional period between financial year-end and your next Annual General Meeting (AGM). For most strata schemes that issue levies quarterly, the structure generally looks like this:

- The body corporate approves four standard levies at the AGM, covering each quarter of the financial year.

- The body corporate approves two additional pre-issued levies at the same meeting, to cover the transitional period at the start of the following financial year.

These pre-issued levies bridge the gap between the end of the current financial year and the next AGM – where the next budget is voted upon.

Why Are They Necessary?

Under the Body Corporate and Community Management Act 1997 (Qld) a body corporate must hold its AGM within three months of their end of financial year.

During the AGM, one of the most important tasks is to review and approve the budget for the upcoming year. In most cases, the committee schedules the AGM closer to the end of that three-month window; and as a result, there’s a transitional period between the financial year end and the formal approval of the new budget. To manage this gap, the body corporate must plan ahead to ensure it can continue to meet its financial commitments without disruption.

How Does This Affect the New Budget?

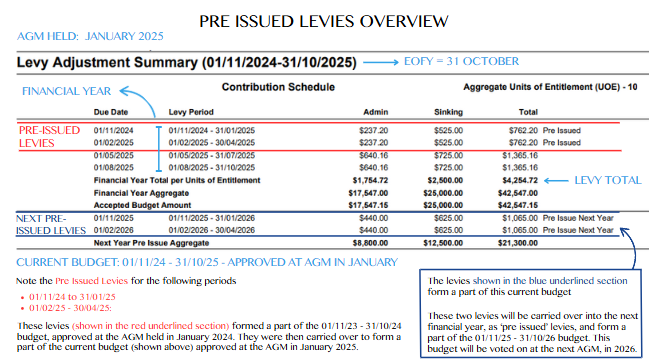

At the AGM, the body corporate approves four standard levies to cover each quarter of the financial year. At the same time, it also approves two additional “pre-issued” levies. These levies carry into the new financial year and bridge the gap until the next AGM, when owners vote on a new budget. Typically, for schemes that collect levies on a quarterly basis, the following structure applies:

- Four standard levies, covering each quarter of the financial year are approved at the AGM.

- Additionally, at the same AGM, two further “pre-issued” levies are approved.

- These two levies are carried over into the new financial year, to bridge the gap until the next AGM occurs and a new budget can be voted upon.

To summarise, pre-issued levies enable the body corporate to continue collecting funds and meeting expenses until owners adopt the new budget.

Practical Example

A scheme’s financial year ends on 31 October, however, the AGM won’t be scheduled until January (per legislation, within 3 months of the scheme’s EOFY). Without pre-issued levies, from 1 November, into the new financial year, the body corporate could have no incoming funds, compromising its ability to pay contractors, maintain facilities, or renew insurance policies.

With pre-issued levies in place, levies for November to to April are already approved, issued, and payable, ensuring your scheme remains financially stable.

Please refer to the diagram below for a visual explanation.

Are Pre-Issued Levies Mandatory?

The Body Corporate and Community Management Act 1997 (Qld) allows a body corporate to issue interim levies to maintain cash flow; however, it does not require pre-issued levies to be raised in advance.

Despite this, most bodies corporate choose to issue pre-approved interim levies, i.e. ‘pre-issued levies’—and for good reason.

This approach is widely considered best practice because it:

- Gives lot owners financial certainty, allowing them to plan and budget more effectively

- Maintains consistent cash flow for the body corporate throughout the transitional period

- Prevents the need for urgent special levies or last-minute funding motions

The body corporate may still issue a levy for the first quarter of the new financial year, even in rare situations where pre-issued levies are not arranged. However, this can reduce transparency and create confusion for owners, especially if the amount or timing catches them off guard. By planning ahead, the body corporate helps ensure a smooth and predictable financial cycle for all stakeholders.

Final Thoughts

Pre-issued levies may seem like a technicality, but they are a practical tool for good financial governance. By approving levies in advance, your body corporate ensures the smooth continuation of essential services and avoids financial strain between budget cycles.

We proactively manage these requirements for our clients, ensuring that financial operations run smoothly, and transparently, without surprises. If you have questions, our expert team is here to support you every step of the way.

Contact TCM Strata today for practical budgeting advice tailored to your community.